Put Your Money To Work

- Up to double digit interest.

- Start as low as $50,000.

- Hands off, passive cash flow.

- Secured by real estate in booming markets.

- All electronic, secure documents.

- Backed by a dedicated team in the USA - no phone trees or offshore call centers.

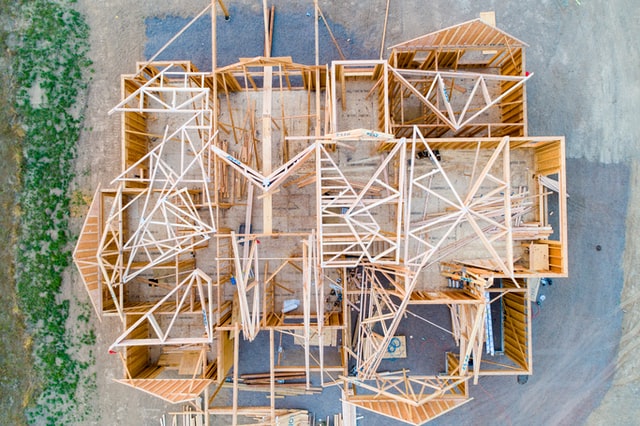

Unbeatable investment - Higher rates, no fees, and 100% secured by real property

Invest in high quality real estate mortgages. First position liens secure your money against real property in growing areas across the United States. Investment opportunities are open to accredited investors as surplus loans are available. Contact us for the latest offerings.

FAQ

Are hard money loans a safe investment?

Every investment has risk. However, hard money loans are relatively “safe” because the debt is secured by real property - a.k.a., land. Land cannot be lost or hidden, and will always have value, which generally increases over time. Also, the loans we offer are no more than 75% loan-to-value, meaning there is always a 25% buffer in case the loan is not repaid.

How can interest rates be so much higher than other investments?

Interest rates are higher because of the nature of the loan and the process involved. Unlike banks or other traditional lending institutions, hard money loans involve a simplified due-diligence process (because the asset is what matters, not the borrower) and are for much shorter terms than the traditional 15 or 30 year loans. Borrowers are willing to pay more for the relatively-quick access to money, short terms, and flexibility in prepayment.

Who can invest?

To invest, you must meet the SEC definition of an “accredited investor.” Generally, this requires either an annual income exceeding $200,000 ($300,000 for joint income) for the last two years with the expectation of earning at least the same in the current year, or a net worth exceeding $1 million. Additionally, an entity entirely owned by accredited investors or with assets exceeding $5 million also qualifies.

Is there a minimum investment amount? A maximum?

Because of the process to verify an accredited investor, the minimum investment amount is $50,000, though this may vary depending on the offering. There is no maximum investment amount, you can invest in multiple loans for as much capital as you want to contribute.

How do I fund the investment? How will I get paid back?

Investing is relatively simple. First, we will need to make sure you appear to meet the requirements of an accredited investor. Second, once verified and you choose which loan you want to invest in, we will send you the necessary paperwork to review and sign. Third, once you sign the paperwork, you will receive instructions for where to wire the funds. Once you’ve wired the funds, that’s it! You’ve successfully funded your investment.

Getting paid back is even easier, and we take care of almost everything. Each month interest will be deposited into your designated account and you will receive a monthly statement, if appropriate, and once the loan matures or the borrower pays it back, whichever comes first, we will take care of the necessary paperwork and deposit your money into your account. You will receive a final statement summarizing the entire loan with each deposit and how much you earned.

How often do I receive payments?

With most loans, you will receive a monthly interest payment, and the remaining balance of the loan will be paid in a balloon payment upon maturity, which may vary between loans.

How is this different than Real Estate investing? Is this a REIT?

We are not a REIT and you are not investing in one. Rather, you are loaning money directly to a borrower, either individually or collectively with other investors. We facilitate this process by performing the necessary due diligence and ensuring the investors receive their share of the proceeds. This is different from real estate investing because you do not purchase or sell property directly, and the security interest in the property is simply insurance against the possibility of default.

Should I invest in hard money loans or the stock market?

This depends on your personal portfolio and the type of investment you seek. Unlike the stock market, hard money loans offer a fixed return and are secured by real property. Also, on average, hard money loans offer a higher return that the stock market, and may deliver steady monthly income. However, hard money loans require a higher initial investment and the principal of that investment is committed for the duration of the loan. Hard money loans can be a great way to diversify a portfolio.

How long does each loan last?

Most loans last between 6 and 24 months, but that can vary on the offering and can always be paid off early. You will be able to see all of the loan information up front before making any decisions.

What happens if a loan is paid off early?

If a loan is paid off early you are free to reinvest your money into a different loan. If possible, we will notify you as soon as the borrower has indicated he may pay the loan early, to give you time to review your available options. If you wish to reinvest your money, the process will be simpler and easier than the initial investment.

What if I want to exit early?

Because of the nature of the agreement with the borrower, you are not free to terminate the term of your investment early. However, if your circumstances have changed, please reach out to us and we will see what we can do to resolve the situation.

What happens if the borrower stops paying or defaults?

If the borrower stops paying or defaults, we will foreclose on the real property to recover the principal, plus interest and any expenses. Though this may extend the time for you to recover your initial investment, in most cases you will earn an even higher return than you would have because of the default interest rate and because we ensure all the properties you invest in are worth more than the amount you invested.

How can I get started?